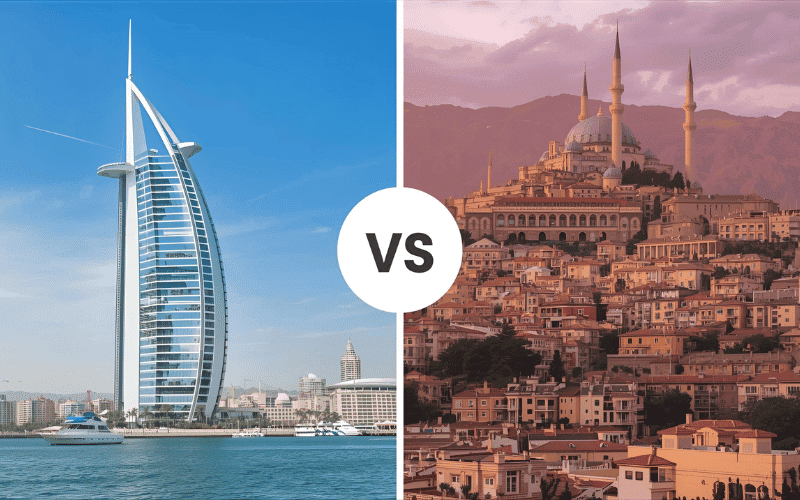

Investing in real estate is a significant decision, especially in vibrant markets like Dubai and Turkey. Both destinations offer unique opportunities for buyers, but which is better for your goals? This guide compares property purchase in Dubai vs. Turkey, focusing on costs, residency benefits, investment returns, and lifestyle factors.

With insights from Uinvest Group, a trusted agency with properties in five countries, we’ll help you navigate this choice.

Overview of Property Markets in Dubai and Turkey

Dubai and Turkey are global hotspots for real estate investment. Dubai, a luxurious metropolis, boasts modern infrastructure and a tax-free environment. Turkey, with its rich history and strategic location, offers affordability and cultural charm. Both markets attract investors, expats, and retirees, but their dynamics differ significantly.

- Dubai: Known for high-end properties and stable economy. Freehold zones allow full ownership for foreigners.

- Turkey: Offers diverse, budget-friendly options. Strong local demand drives growth, especially in Istanbul and Antalya.

Property Prices and Affordability

Cost is a key factor in property investment. Dubai’s real estate leans toward luxury, while Turkey offers more affordable entry points.

- Dubai: Average price per square meter starts at $2,500 in budget areas like International City, reaching $12,000 in elite zones like Palm Jumeirah. Minimum property cost for residency is $205,000 (AED 750,000).

- Turkey: Prices start at $875 per square meter in Istanbul and $650-$900 in coastal areas like Antalya or Alanya. Properties for residency start at $75,000.

Turkey is more affordable, ideal for budget-conscious buyers. Dubai’s higher prices reflect its premium lifestyle and infrastructure.

Table: Property Price Comparison

| Location | Avg. Price per sq m (USD) | Min. Property Cost for Residency (USD) | Best For |

| Dubai | $2,500–$12,000 | $205,000 | Luxury seekers, investors |

| Turkey | $650–$4,380 | $75,000 | Budget buyers, families |

Ownership and Legal Considerations

Legal frameworks impact foreign buyers. Both countries allow foreigners to purchase property, but ownership types and restrictions vary.

- Dubai: Foreigners can buy freehold properties in designated zones (e.g., Dubai Marina, Downtown Dubai). Leasehold options (10–99 years) are available elsewhere. No annual property taxes, but a 4% transfer fee applies.

- Turkey: Full freehold ownership is permitted in most areas, except strategic zones. A 4% purchase tax and low annual property tax (0.1–0.3% of cadastral value) apply. Expert valuation is mandatory, costing ~$250.

Turkey offers simpler ownership with fewer restrictions. Dubai’s freehold zones are appealing but limited to specific areas.

Residency and Citizenship Benefits

Property investment often ties to residency or citizenship goals. Both countries offer pathways, but conditions differ.

- Dubai: A property worth $205,000 (AED 750,000) grants a 3-year renewable residency visa. Properties over $544,000 (AED 2M) qualify for a 10-year Golden Visa. Citizenship is nearly impossible for foreigners.

- Turkey: A $75,000 property grants temporary residency. Investing $400,000 in real estate qualifies for citizenship, with dual citizenship allowed. Properties cannot be sold for 3 years to retain citizenship.

Turkey’s citizenship program is more accessible. Dubai’s residency visas suit expats seeking flexibility without permanent status.

Investment Returns and ROI

Return on investment (ROI) is critical for investors. Both markets offer rental income and capital appreciation, but yields vary.

- Dubai: Average rental yield is 5–10%, with some areas reaching 28%. Stable currency (pegged to USD) ensures predictable returns.

- Turkey: Yields average 6–6.5%, with faster price growth (e.g., Istanbul prices rose from $1,010 to $1,700 per sq m in 2022). Economic volatility may affect returns.

Dubai offers higher rental yields, especially for luxury properties. Turkey excels in price appreciation, ideal for long-term gains.

Table: Investment Returns Comparison

| Location | Avg. Rental Yield | Capital Appreciation Potential | Currency Stability |

| Dubai | 5–10% (up to 28%) | Moderate | High (USD-pegged) |

| Turkey | 6–6.5% | High | Moderate (Lira volatility) |

Cost of Ownership and Maintenance

Ongoing costs impact long-term affordability. These include maintenance, taxes, and utilities.

- Dubai: No annual property tax. Maintenance fees range from $20–$100 per sq m annually. Monthly housing fees (5% of rental value) apply. Total upkeep for a Dubai apartment is 2–4 times higher than in Turkey.

- Turkey: Annual property tax is 0.1–0.3% of cadastral value. Monthly “aidat” fees range from $15–$150, depending on the complex. Utilities and insurance are lower than in Dubai.

Turkey’s lower maintenance costs suit budget-conscious owners. Dubai’s higher fees reflect premium amenities.

Lifestyle and Infrastructure

Lifestyle influences property decisions. Dubai and Turkey offer distinct living experiences.

- Dubai: Ultra-modern with world-class amenities (e.g., malls, public transport). Low crime rates and high safety make it family-friendly. Cost of living is higher (e.g., $289/day vs. $192 in Istanbul).

- Turkey: Rich cultural heritage, affordable living, and diverse landscapes. Coastal cities like Antalya offer relaxed vibes. Unemployment is higher (12.94% vs. 2.45% in UAE).

Dubai suits those seeking luxury and safety. Turkey appeals to those valuing affordability and culture.

Economic Stability and Market Trends

Economic factors affect investment security. Currency and market trends play a role.

- Dubai: Stable economy tied to tourism and services. Currency (AED) is USD-pegged, with only 3.6% fluctuation in 15 years. Market volatility exists due to global events.

- Turkey: Diverse economy (agriculture, industry, tourism). Turkish Lira faces volatility, impacting returns in USD terms. Strong local demand supports market growth.

Dubai offers stability; Turkey offers growth potential despite currency risks.

Mortgage and Financing Options

Financing affects accessibility for foreign buyers.

- Dubai: Mortgages require a 20–25% down payment for foreigners (15% for locals). Rates range from 4–7%. International banks like HSBC cater to expats.

- Turkey: Mortgage rates are higher (6–15%), with flexible terms. Lower property prices reduce overall loan amounts.

Dubai’s lower rates favor financing, but Turkey’s affordability eases cash purchases.

Cultural and Legal Considerations for Expats

Cultural fit and legal ease matter for foreign buyers.

- Dubai: Strict laws require adherence to avoid visa issues. Expat-friendly but less inclusive for non-citizens. English is widely spoken.

- Turkey: More liberal culture, especially in coastal cities. Foreigners face fewer social barriers. Turkish language knowledge helps but isn’t mandatory.

Turkey offers a more relaxed cultural environment. Dubai demands stricter compliance.

Risk Analysis for Property Investment

Investing involves risks. Understanding them ensures informed decisions.

- Dubai: Low political risk and stable currency. Oversupply in areas like Dubai Hills may lower prices. Global economic shifts impact luxury markets.

- Turkey: Currency volatility risks USD-based returns. Political changes may alter regulations. High local demand mitigates some risks.

Dubai offers lower risk for stable returns. Turkey’s higher risks are balanced by growth potential.

Popular Regions for Property Purchase

Specific regions attract buyers. Comparing them highlights unique opportunities.

- Dubai:

- Downtown Dubai: Luxury hub with high ROI (7–10%). Prices: $5,000–$12,000/sq m.

- Dubai Marina: Waterfront, expat-friendly. Prices: $3,500–$8,000/sq m.

- JVC: Affordable, family-oriented. Prices: $2,500–$4,000/sq m.

- Turkey:

- Istanbul (Beylikdüzü): Budget-friendly, growing demand. Prices: $875–$2,000/sq m.

- Antalya: Coastal, retiree-friendly. Prices: $650–$1,500/sq m.

- Alanya: Affordable, tourist-driven. Prices: $700–$1,800/sq m.

Downtown Dubai suits luxury investors. Antalya and Alanya appeal to retirees and budget buyers.

Table: Popular Regions Comparison

| Region | Avg. Price per sq m (USD) | Key Features | Best For |

| Downtown Dubai | $5,000–$12,000 | Luxury, high ROI | High-net-worth investors |

| Dubai Marina | $3,500–$8,000 | Waterfront, expat hub | Professionals, families |

| JVC (Dubai) | $2,500–$4,000 | Affordable, community-focused | Budget buyers, families |

| Istanbul (Beylikdüzü) | $875–$2,000 | Urban, growing demand | Investors, young professionals |

| Antalya | $650–$1,500 | Coastal, relaxed vibe | Retirees, vacation home seekers |

| Alanya | $700–$1,800 | Affordable, tourist-friendly | Budget investors, retirees |

Impact of Local Culture on Property Choices

Cultural factors influence property preferences. Understanding these ensures better decisions.

- Dubai: Cosmopolitan, fast-paced culture prioritizes modernity. High-rise apartments dominate, emphasizing privacy and convenience.

- Turkey: Traditional, communal culture values family-oriented homes. Villas and low-rise apartments are popular in coastal areas. Social spaces are key.

Dubai suits modern, urban lifestyles. Turkey aligns with community-focused, cultural living.

Tax Implications for Property Owners

Taxes affect long-term costs. Each country has unique tax structures.

- Dubai: No income or annual property tax. A 4% transfer fee and 0.5% mortgage registration fee apply. Service charges ($20–$100/sq m) cover amenities.

- Turkey: A 4% purchase tax and 0.1–0.3% annual tax apply. Low “aidat” fees ($15–$150/month) cover maintenance. Tax compliance is straightforward.

Dubai’s tax-free status is attractive. Turkey’s low taxes suit budget-conscious owners.

Infrastructure Development and Future Growth

Infrastructure drives property value growth. Both countries invest heavily, impacting future returns.

- Dubai: Ongoing projects like Dubai Creek Harbour and Expo City enhance value. Metro expansions improve connectivity. Future-proof urban planning attracts investors.

- Turkey: Mega-projects like Istanbul’s Canal Istanbul and airport expansions boost demand. Coastal developments in Antalya promise tourism growth.

Dubai’s infrastructure is advanced; Turkey’s is rapidly developing.

Property Management and Support Services

Managing properties remotely is common for foreign buyers. Support services vary.

- Dubai: Professional property management firms handle leasing and maintenance. Fees range from 5–10% of rental income. Uinvest Group connects buyers to reliable services.

- Turkey: Local agencies offer affordable management (3–7% of rental income). Coastal areas have robust support for vacation rentals.

Dubai’s services are premium but costly. Turkey’s are budget-friendly and accessible.

Recommended Articles:

- Comparing Property Investment in Dubai vs. Turkey: Which is Better?

- How to Find Below Market Value Property in Dubai

- How to Buy Property in Dubai on a Low Budget?

- Can Foreigners Buy Apartments in Dubai?

- How Much to Buy Apartment in Dubai in 2025?

- Best Areas to Buy an Apartment in Dubai in 2025

- Is Buying an Apartment in Dubai Still a Wise Investment in 2025?

Sustainability in Real Estate Investment

Sustainability influences modern buyers. Both markets adopt eco-friendly practices.

- Dubai: Green building standards (e.g., LEED certification) in new developments. Solar panels and energy-efficient systems are common.

- Turkey: Coastal projects emphasize sustainable materials. Government incentives promote green construction in Antalya and Alanya.

Dubai leads in high-tech sustainability. Turkey focuses on affordable eco-solutions.

Choosing Between Dubai and Turkey for Property Purchase

Deciding where to buy property depends on your priorities. Dubai offers luxury, high rental yields (5–10%), and a tax-free environment, ideal for those seeking a premium lifestyle and stable returns. Turkey provides affordability, citizenship options, and strong price growth, perfect for budget-conscious buyers or long-term investors. Both markets shine, but your goals—luxury vs. value, residency vs. citizenship—drive the choice.

Uinvest Group, a professional and trustworthy agency, offers properties for sale in five countries, helping you find the perfect investment in Dubai or Turkey. Start your journey today and secure your dream property.

15 Essential FAQs on Property Purchase in Dubai vs. Turkey

1.What are the main differences in property prices?

Dubai’s prices start at $2,500/sq m; Turkey’s at $650–$4,380/sq m. Turkey is more affordable.

2. Can foreigners buy property in both countries?

Yes, Dubai allows freehold in designated zones; Turkey permits it in most areas.

3. What residency benefits come with property purchase?

Dubai offers 3-year (from $205,000) or 10-year ($544,000) visas. Turkey provides residency ($75,000) or citizenship ($400,000).

4. Which has better rental yields?

Dubai averages 5–10% (up to 28%); Turkey offers 6–6.5%.

5. How do maintenance costs compare?

Dubai’s upkeep is 2–4 times higher than Turkey’s low aidat fees ($15–$150/month).

6. Is Dubai or Turkey safer for property investment?

Dubai’s low crime and stable currency ensure safety. Turkey’s growth is promising but riskier due to Lira volatility.

7. What are the tax implications?

Dubai has no annual property tax, only a 4% transfer fee. Turkey has a 4% purchase tax and 0.1–0.3% annual tax.

8. Which country offers better financing?

Dubai’s mortgage rates (4–7%) are lower than Turkey’s (6–15%).

9. How does currency stability affect investments?

Dubai’s AED is USD-pegged, ensuring stability. Turkey’s Lira fluctuates, impacting returns.

10. Which market has stronger growth potential?

Turkey’s prices grow faster (e.g., 3–4x in high-demand areas). Dubai’s growth is steadier.

11. Are there restrictions on property types?

Dubai limits foreigners to freehold zones. Turkey restricts only strategic areas.

12. Which is better for families?

Dubai’s safety and amenities suit families. Turkey’s affordability and culture appeal to diverse households.

13. How do I find properties in Dubai or Turkey?

Uinvest Group offers trusted properties across five countries, including Dubai and Turkey.

14. What cultural factors should expats consider?

Dubai requires strict legal compliance. Turkey’s liberal culture is more welcoming.

15. Which is better for short-term vs. long-term investment?

Dubai excels for short-term rental yields; Turkey for long-term price appreciation.