Taxes on Vehicle Purchases in Turkey

Acquiring a vehicle in Turkey can mark an exciting achievement; however, it frequently entails a considerable financial commitment due to taxes. Expenses such as Value Added Tax (VAT), Special Consumption Tax (SCT), and registration fees contribute to a notable tax load on the overall price of a car in Turkey. It is essential to comprehend these taxes to make a well-informed decision, whether you are a local resident or an international buyer.

The taxation framework for vehicles in Turkey is among the most intricate globally, particularly regarding imported and luxury cars. These taxes serve not only as a means for the government to collect revenue but also as a mechanism to manage vehicle imports and promote environmentally friendly transportation options.

Overview of the Turkish Vehicle Market

Turkey’s vehicle market has been expanding steadily, driven by both domestic demand and foreign interest. The country produces a large number of cars locally, yet imported vehicles—especially luxury brands—remain popular.

Due to high SCT and VAT rates, car prices in Turkey are among the highest in Europe. This taxation model has encouraged many buyers to opt for smaller-engine or hybrid cars to reduce costs.

Key Tax Types When Purchasing a Vehicle in Turkey

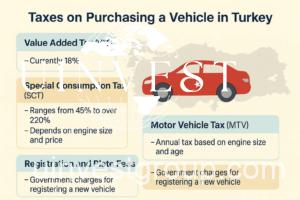

When you buy a car in Turkey, you typically need to pay:

-

Value Added Tax (VAT) – Currently set at 18% for most vehicles.

-

Special Consumption Tax (SCT) – Varies from 45% to over 220% depending on engine size and price.

-

Motor Vehicle Tax (MTV) – An annual tax based on engine size and vehicle age.

-

Registration and Plate Fees – Required for all new vehicles.

-

Inspection and Road Usage Fees – TÜVTÜRK inspection charges every 2 years for cars.

Each of these taxes has its own calculation method and timing for payment.

Value Added Tax (VAT) on Vehicle Purchases

VAT is applied on top of the vehicle’s price plus the SCT. This means you pay VAT not just on the car’s base price, but also on the already-taxed amount.

Formula:

Final Price = (Base Price + SCT) + VAT on total.

Example: If a car’s base price is ₺500,000 and SCT is 80%, the taxable amount for VAT becomes ₺900,000 (₺500,000 + ₺400,000), and 18% VAT adds ₺162,000.

Special Consumption Tax (SCT) Explained

SCT is the single most impactful tax when purchasing a vehicle in Turkey. It varies widely depending on:

-

Engine size (measured in cubic centimeters)

-

Vehicle price (before taxes)

-

Fuel type (petrol, diesel, electric, hybrid)

For small-engine economy cars, SCT can be as low as 45%. For luxury vehicles with engines over 2000cc, SCT can exceed 220%.

How Engine Size Impacts SCT in Turkey

One of the most critical factors influencing the Special Consumption Tax (SCT) rate is the engine displacement. In Turkey, SCT is calculated in a tiered structure, and even a small difference in cubic centimeters can drastically change the tax you pay.

-

Small engines (up to 1600cc) — Lower SCT rates, often between 45% and 80%, making them the most popular among Turkish buyers.

-

Medium engines (1601–2000cc) — Higher SCT, often exceeding 130%, significantly increasing the final price.

-

Large engines (over 2000cc) — The highest SCT rates, which can exceed 220%, often doubling or tripling the base price.

This system is designed to discourage luxury imports and promote fuel efficiency.

Price Brackets and SCT Rates

The SCT is not just about engine size—it also changes depending on the vehicle’s base price. For example:

| Engine Size | Vehicle Base Price (TRY) | SCT Rate |

|---|---|---|

| ≤1600cc | ≤₺500,000 | 45% |

| ≤1600cc | ₺500,001–₺800,000 | 80% |

| 1601–2000cc | ≤₺500,000 | 130% |

| 1601–2000cc | ₺500,001–₺800,000 | 150% |

| >2000cc | Any price | 220%+ |

By combining engine size and price, the SCT creates a steep price curve for higher-end vehicles.

Motor Vehicle Tax (MTV) in Turkey

MTV is an annual road tax that every vehicle owner in Turkey must pay. Unlike SCT and VAT, which are one-time payments upon purchase, MTV recurs every year.

It is calculated based on:

-

Engine size

-

Vehicle age

-

Vehicle type (car, motorcycle, truck, etc.)

For example:

-

A car with a 1.6L engine under 1 year old may have an annual MTV of around ₺3,000–₺4,000.

-

An older, smaller vehicle might only pay around ₺1,000–₺2,000 per year.

Payments are made in two installments—January and July.

Registration and Plate Fees

Once you buy your car, you must register it with the General Directorate of Security (Emniyet Genel Müdürlüğü). Registration involves:

-

Vehicle registration fee — Varies depending on the plate code region.

-

License plate manufacturing fee — Fixed, usually around ₺100–₺150.

-

Notary fee — Paid if buying from a private seller, not required for new cars from a dealer.

Without registration, you cannot legally drive the car.

Road Usage and Inspection Fees

In Turkey, roadworthiness checks are mandatory. The TÜVTÜRK inspection must be done:

-

Every 2 years for private passenger cars.

-

Every year for commercial vehicles.

A standard inspection costs around ₺1,100–₺1,200. Failing an inspection means you must repair issues and return for a re-check, which incurs an additional fee.

Differences in Taxes for New vs. Used Vehicles

When buying a new vehicle, you pay SCT + VAT on the purchase price.

For used vehicles purchased from a dealership:

-

VAT may still apply, but at a lower effective rate (dealers often pay VAT on profit margin rather than full price).

-

SCT is not paid again, since it was already included in the original purchase.

Private sales between individuals usually avoid VAT, but notary transfer fees apply.

Taxes for Imported Vehicles in Turkey

Importing a car into Turkey is significantly more expensive than buying locally due to:

-

Customs duties — Often around 10% for EU vehicles, higher for non-EU countries.

-

SCT and VAT — Applied to the customs-inclusive price.

-

Transportation and logistics costs — Shipping, port fees, and handling.

Combined, these costs can push the final price to more than double the vehicle’s market price abroad.

Electric Vehicle Tax Rates in Turkey

Turkey has been encouraging electric vehicle (EV) adoption with lower SCT rates:

-

EVs up to 160kW — SCT around 10%–15%.

-

EVs over 160kW — SCT around 40%.

However, VAT at 18% still applies, and MTV is calculated based on power output instead of engine size.

Hybrid Vehicles and Tax Benefits

Hybrid vehicles receive partial tax relief depending on their engine size and electric motor capacity. While not as low as full EV rates, hybrid SCT is often 20–30% less than equivalent gasoline vehicles.

Exemptions and Discounts on Vehicle Taxes

Certain groups receive tax exemptions or reductions, including:

-

Disabled drivers with medical documentation (SCT and VAT exemptions up to a price limit).

-

Diplomatic staff.

-

Vehicles used for agricultural purposes.

-

How to Calculate Total Cost of Vehicle Ownership in Turkey

Here’s a step-by-step example for a ₺500,000 base price car, 1.6L engine:

-

Base Price: ₺500,000

-

SCT (45%): ₺225,000 → Subtotal: ₺725,000

-

VAT (18% of subtotal): ₺130,500 → Final purchase price: ₺855,500

-

Registration & Plates: ~₺1,000

-

Annual MTV: ~₺3,000

-

Buying a Vehicle as a Foreigner in Turkey

Foreigners can buy vehicles in Turkey, but must register them with Foreigner Identification Number (YKN). Taxes are generally the same as for locals, though foreign diplomats and expats with special permits may get exemptions.

Impact of Exchange Rate on Vehicle Taxes

Because vehicle prices are often based on euro or dollar values, fluctuations in the Turkish lira directly impact SCT brackets and final costs. A weaker lira increases prices and can push cars into higher tax categories.

Steps to Pay Vehicle Taxes in Turkey

Taxes can be paid:

-

Online via e-Devlet or bank portals.

-

In-person at banks, tax offices, or PTT branches.

Common Mistakes When Calculating Vehicle Taxes

-

Forgetting that VAT is calculated on the SCT-inclusive price.

-

Not considering annual MTV in the budget.

-

Overlooking registration and inspection costs.

Penalties for Not Paying Vehicle Taxes

Failure to pay MTV or registration fees can result in:

-

Late payment penalties (daily interest).

-

Vehicle seizure in extreme cases.

Refunds on Vehicle Taxes in Certain Cases

Refunds are rare, but possible if:

-

The vehicle is exported.

-

Taxes were overpaid due to clerical errors.

Recent Changes in Turkish Vehicle Tax Laws

The government regularly adjusts SCT brackets to align with inflation and currency fluctuations. In recent years, price thresholds have been lowered, pushing more cars into higher tax categories.

Comparing Turkey’s Vehicle Taxes with Other Countries

Compared to the EU average, Turkey’s SCT rates are significantly higher, making luxury cars much more expensive. This policy is meant to protect the domestic auto industry.

Tips for Reducing Vehicle Purchase Taxes in Turkey

-

Choose a smaller engine.

-

Buy during times when SCT brackets are adjusted.

-

Consider hybrid or electric vehicles for lower SCT rates.

Best Time of Year to Buy a Vehicle in Turkey

End-of-year or pre-tax-bracket adjustments are often the best time to buy, as dealers may offer incentives before price increases.

Case Study: Tax Breakdown for a Sedan in Turkey

Base price: ₺600,000 (1.6L engine, falls into 80% SCT bracket)

-

SCT: ₺480,000 → Subtotal: ₺1,080,000

-

VAT (18%): ₺194,400 → Final Price: ₺1,274,400

-

Additional fees: ~₺4,000 for registration, plates, and inspection.

Future of Vehicle Taxation in Turkey

Experts predict more incentives for EVs, but also tighter SCT brackets to maintain government revenue.

Conclusion: Navigating Taxes on Purchasing a Vehicle in Turkey

Buying a vehicle in Turkey requires careful planning and understanding of the complex tax system. With SCT, VAT, MTV, and other fees, the final cost can be much higher than expected. By learning the rules, choosing the right vehicle type, and timing your purchase, you can save thousands of lira.

FAQs about Taxes on Purchasing a Vehicle in Turkey

What is the biggest tax when buying a car in Turkey?

The Special Consumption Tax (SCT) is the largest component, sometimes exceeding 200% for luxury vehicles.

Do foreigners pay more taxes on cars in Turkey?

No, taxes are generally the same for locals and foreigners, except for certain exemptions.

Are electric cars taxed in Turkey?

Yes, but at lower SCT rates compared to gasoline and diesel cars.

Can I avoid paying VAT on a car in Turkey?

Only in special cases such as diplomatic exemptions or certain disability benefits.

Is MTV included in the purchase price?

No, MTV is an annual tax separate from the initial purchase cost.

Can vehicle taxes in Turkey change every year?

Yes, the government regularly updates SCT brackets and MTV rates.