Invest Smart: Know the Legal Landscape in Georgia

Georgia has become one of the most attractive destinations for foreign investors, thanks to its liberal investment climate, strategic location, and low-tax environment. However, like any international investment, it’s vital to understand the legal landscape before diving in. This article explores all the legal issues investors need to know before investing in Georgia, with a focus on the cities of Batumi and Tbilisi. With expert legal guidance from UInvest Group, you can navigate the system with confidence, whether you’re purchasing property, launching a business, or investing in tourism infrastructure.

Why Georgia Is Attracting Global Investors

Georgia offers a mix of affordability, investment incentives, and low bureaucracy that is rare in Europe. Ranked high in the World Bank’s “Ease of Doing Business” index, it has made significant reforms to attract investors in:

-

Real estate

-

Hospitality

-

Agriculture

-

Energy

-

Logistics

Both Batumi, the seaside tourism capital, and Tbilisi, the business and cultural hub, are focal points of real estate and commercial investment. But entering these markets without proper legal support can be risky.

Batumi vs. Tbilisi: Two Investment Hotspots

-

Batumi: Known for its coastal lifestyle and booming tourism sector, Batumi is ideal for short-term rental income and resort-style property investment.

-

Tbilisi: As Georgia’s capital, it attracts foreign businesses, long-term tenants, and commercial real estate investors.

Both cities offer high ROI potential, but they differ in legal complexities, zoning, and market dynamics—underscoring the need for tailored legal services.

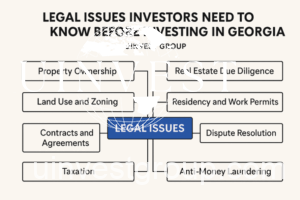

Legal Framework for Foreign Investors in Georgia

Georgia permits full property ownership for foreigners, with very few restrictions. Business registration, tax policy, and banking procedures are also investor-friendly. However, investors must comply with:

-

Civil Code

-

Tax Code

-

Urban Development and Zoning Laws

-

Contract Law

-

Real Estate Registration Rules

-

Residency Regulations

Understanding these frameworks ensures legal protection and peace of mind.

UInvest Group – Legal Services for Investors in Georgia

UInvest Group is a leading provider of legal services in Georgia, helping investors:

-

Conduct due diligence

-

Draft and review contracts

-

Ensure tax compliance

-

Register property

-

Apply for residency

-

Navigate disputes or developer conflicts

Whether you’re investing in Batumi or Tbilisi, UInvest Group offers multilingual support, legal accuracy, and full transaction transparency.

Property Ownership Laws for Foreigners

Foreign nationals and companies can freely purchase residential and commercial properties. The only restriction is on agricultural land, which can only be purchased under special rules or via registered Georgian entities.

UInvest Group assists in:

-

Structuring purchases legally

-

Setting up local entities if needed

-

Avoiding land-use issues

Notable Projects by Mardi and Horizon — Legally Backed by UInvest Group

Georgia’s real estate market is booming, with standout developments from industry leaders like Mardi Holding and Horizons Group gaining significant investor interest—each meticulously supported by UInvest Group’s legal oversight. Among Mardi’s high-profile ventures showcased on the UInvest platform are Mardi City Center, a strategically located residential-commercial complex in Batumi , and Mardi Hills, an elevated premium residential project offering panoramic Black Sea and city views . On the Horizon side, UInvest features Horizon Elegance, a modern aparthotel development just 150 meters from the sea with turnkey amenities and robust infrastructure . These projects exemplify the attractive blend of lifestyle and investment appeal—but navigating them legally can be complex. That’s why UInvest Group ensures every stage—from due diligence and contract notarisation to property registration—is handled with precision and transparency.

Due Diligence: A Critical First Step

Before signing anything, investors must verify:

-

Seller’s ownership rights

-

Any encumbrances or liens

-

Construction legality and developer registration

-

Building permit approvals

This process, often overlooked by novice investors, is where UInvest Group excels—ensuring every project is legally sound.

Verifying Title and Property Status

Georgia’s Public Registry system offers online title verification tools. However, for foreigners unfamiliar with the language and local procedures, professional verification by legal experts ensures accuracy.

UInvest Group handles:

-

Document reviews

-

Registry checks

-

Title transfers

Zoning, Construction Permits, and Urban Development Compliance

Whether in Batumi’s beachfront zone or Tbilisi’s historic center, zoning laws determine permissible property use.

Legal advisors check:

-

If property is zoned for residential, commercial, or hospitality use

-

Developer compliance with urban planning laws

-

Permits for ongoing or future construction

Understanding Georgia’s Contract Law for Real Estate

Contracts in Georgia are legally binding when:

-

Signed by both parties

-

Notarized (in many cases)

-

Compliant with Georgian civil law

UInvest Group provides:

-

Bilingual contract drafting

-

Risk assessments

-

Legal translations

They ensure your rights are protected in all real estate and commercial agreements.

Notary Requirements and Apostille Documents

To be enforceable, many documents require notarization. Foreign documents like powers of attorney or identity documents may need:

-

Apostille authentication

-

Certified Georgian translations

UInvest Group handles notarization and liaises with public notaries across Batumi and Tbilisi.

Tax Implications for Foreign Investors

Georgia’s low tax regime includes:

-

0% on capital gains from real estate held for over 2 years

-

1%-5% personal income tax on rental income

-

No inheritance tax

-

5% property transfer tax

UInvest Group offers tax structuring and registration assistance to ensure full compliance.

Banking, Currency Exchange, and Escrow Options

Although Georgia uses the Georgian Lari (GEL), property transactions can often be negotiated in USD or EUR. UInvest Group:

-

Assists in opening local bank accounts

-

Coordinates international transfers

-

Secures escrow arrangements to protect buyer funds

Registering Property with Georgia’s Public Registry

Ownership isn’t official until registered with the National Agency of Public Registry (NAPR). UInvest Group handles:

-

Digital submission

-

Fee payments

-

Follow-ups with registry officials

Registration usually completes within 1-2 business days.

Legal Considerations in Rental Agreements and Management

Investors planning to rent out units need:

-

Legally compliant lease agreements

-

Tax reporting tools

-

Tenant eviction clauses

UInvest Group also supports long-term property management setup.

Licenses and Regulatory Requirements for Business Investments

Starting a hotel, restaurant, or retail outlet? You may need:

-

Construction permits

-

Operation licenses

-

Environmental and fire inspections

UInvest Group helps you register a business and secure all necessary approvals.

Residency and Legal Stay Through Investment

Investors purchasing real estate worth over $100,000 USD can apply for a 1-year renewable residence permit, which can lead to long-term residency.

UInvest Group provides:

-

Legal support for residency applications

-

Translation of supporting documents

-

Liaison with immigration services

Risk Mitigation and Investor Protection Laws

Georgia offers mechanisms such as:

-

Legal recourse against fraudulent developers

-

Public court records access

-

Real estate insurance options

UInvest Group conducts pre-purchase risk analysis and dispute prevention services.

Dispute Resolution and Arbitration in Georgia

In case of disputes, Georgia allows:

-

Civil court procedures

-

Arbitration via the Tbilisi Arbitration Institute

-

Mediation for landlord–tenant issues

UInvest Group represents clients in court or arbitration panels when needed.

Legal Mistakes to Avoid When Investing in Georgia

-

Skipping due diligence

-

Signing non-notarized contracts

-

Failing to register property correctly

-

Overpaying taxes due to poor structuring

-

Trusting unverified developers or agents

All of these mistakes can be avoided with UInvest Group’s end-to-end legal supervision.

Case Studies: Investor Experiences in Batumi and Tbilisi

-

Investor A (Batumi): Purchased two rental units with UInvest Group’s legal help—rental income exceeded 10% annually.

-

Investor B (Tbilisi): Opened a café; UInvest Group handled business registration, licensing, and lease negotiations.

-

Investor C (Batumi): Resolved a property dispute in court thanks to UInvest’s legal team, preserving a six-figure investment.

Frequently Asked Questions About Legal Issues for Investors in Georgia

Can foreigners legally buy property in Georgia?

Yes. Georgia allows foreign nationals and foreign-registered companies to purchase residential and commercial real estate with full ownership rights. The only restriction is on agricultural land, which can only be purchased by Georgian entities. UInvest Group can help foreign investors set up legal structures if needed.

What are the most common legal risks when investing in real estate in Georgia?

Some common legal risks include:

-

Buying property with unresolved liens or debts

-

Purchasing from unauthorized developers

-

Entering into contracts that lack legal protection

-

Misunderstanding zoning or usage laws

-

Failure to register the property correctly

UInvest Group mitigates these risks through thorough due diligence, title verification, and legal oversight of contracts and registration.

Do I need to notarize property contracts in Georgia?

Yes. Real estate purchase agreements must be notarized by a licensed notary to be legally binding. UInvest Group facilitates all notarial processes and ensures contracts are compliant with Georgian civil law.

What taxes do foreign investors need to pay in Georgia?

Taxes related to property investment include:

-

5% property transfer tax (paid once upon purchase)

-

1% to 5% personal income tax on rental income

-

0% capital gains tax if property is held for more than 2 years

-

Annual property tax (usually less than 1% of assessed value)

UInvest Group provides tax compliance advice and helps structure investments to optimize returns.

How long does it take to register a property in Georgia?

Property registration typically takes 1–2 business days once all documents are submitted to the National Agency of Public Registry (NAPR). UInvest Group handles the submission and monitors the process until ownership is officially transferred.

Can I open a bank account in Georgia as a foreign investor?

Yes. Foreigners can easily open personal or business bank accounts. UInvest Group offers assistance with bank selection, documentation, and currency exchange to facilitate property payments or investment transfers.

What legal documents are required when buying property in Georgia?

You will typically need:

-

A notarized purchase agreement

-

Valid identification (passport)

-

Power of attorney (if acting through a representative)

-

Proof of payment or escrow

-

Translated and apostilled documents (if issued abroad)

UInvest Group ensures all documentation is correctly prepared and translated.

Is there a legal path to residency in Georgia through investment?

Yes. If you invest over $100,000 USD in real estate, you become eligible for a 1-year renewable residence permit, which can lead to longer-term residency or permanent status. UInvest Group manages the application process and liaises with immigration authorities.

Are contracts in English accepted in Georgian courts?

No. Legal contracts must be in Georgian or officially translated to be enforceable in Georgian courts. UInvest Group provides certified translations and ensures all documents meet legal standards.

What should I know about investing in off-plan (pre-construction) projects in Batumi or Tbilisi?

Off-plan projects can be profitable but riskier. Key legal checks include:

-

Developer’s license and track record

-

Approved construction permits

-

Completion guarantees

-

Payment structure terms

-

Clauses for delays or non-completion

UInvest Group conducts detailed due diligence and structures protective clauses in off-plan agreements.

What happens if there’s a legal dispute over property or contracts?

Disputes can be resolved through:

-

Civil courts

-

Arbitration tribunals (such as the Tbilisi Arbitration Institute)

-

Mediation services

UInvest Group represents clients in disputes, including breach of contract, construction defects, or tenant issues.

Is it better to invest in Batumi or Tbilisi from a legal standpoint?

Both cities have investor-friendly legal frameworks. However:

-

Batumi: Fast-paced development may require deeper due diligence with developers.

-

Tbilisi: Denser regulations on commercial space and historical districts.

UInvest Group has legal teams in both cities, providing city-specific legal strategies.

Can I structure my investment through a Georgian company?

Yes. Many investors use local LLCs to buy property or operate businesses. UInvest Group can register your company, file taxes, and ensure compliance with local laws.

What is the role of UInvest Group in legal services for foreign investors?

UInvest Group acts as your legal partner for:

-

Property verification and title checks

-

Contract drafting and notarization

-

Property registration

-

Tax planning and residency permits

-

Business setup and licensing

-

Dispute resolution and litigation support

Their comprehensive service ensures your investment in Georgia is secure, profitable, and legally protected.

Conclusion

Georgia offers unparalleled opportunities for foreign investors, especially in dynamic cities like Batumi and Tbilisi. But to make safe and profitable investments, legal knowledge is essential. From title verification to residency support, UInvest Group delivers expert legal services for investors in Georgia—ensuring that every transaction is smooth, compliant, and secure. With the right legal partner, your investment in Georgia can be both lucrative and legally protected.